Auto insurance fraud is one of the most common and costly types of insurance fraud around the world. In the U.S. alone, about 20% of auto insurance company payouts go to fraudsters every year, costing the average family $400-700 per year in higher premiums.

In this blog post, a follow-up to our previous post about insurance fraud, we will discuss how data collaboration and privacy-preserving AI can enhance fraud detection. We’ll start with a quick overview of auto insurance fraud.

What Is Auto Insurance Fraud?

Generally speaking, property and casualty insurance (P&C), which includes auto insurance, protects consumers if their property is damaged or stolen, or if they injure another person or damage their property.

Auto insurance fraud can be divided into soft fraud and hard fraud.

- Soft fraud usually involves exaggerating an event or claim – such as stating that a dent in your bumper caused by scraping the wall of your garage was actually from a hit-and-run accident.

- Hard fraud is usually more serious and involves larger payouts, like faking an accident or falsely claiming that a car was stolen.

Regulation and Public-Private Coordination

Due to the high cost and prevalence of auto insurance fraud, governments have intervened in some cases. One example of public-private coordination in the U.S. is the National Motor Vehicle Title Information System (NMVTIS), which enables states to check all state record systems to verify the accuracy and legitimacy of vehicle title information. NMVTIS is also a tool for insurance companies to investigate vehicle histories. Insurance companies must report monthly to NMVTIS on the junk and salvage automobiles they obtain.

In the U.S., five states – Florida, Massachusetts, New Jersey, New York, and Rhode Island – require pre-insurance inspections before people can purchase physical damage coverage (collision and comprehensive). The Carco Group is the main company that compiles reports, taking information from the car inspection and forwarding it to the insurance company. Carco estimates that these inspections have revealed around $1.8 billion in pre-existing damage in New York alone from 2014 to 2018, saving insurers over $100 million in false claims. These savings hint at further gains that could be made in the fight against fraud by leveraging data and technology in new ways.

How Auto Insurers Are Embracing AI

As insurance fraudsters become more sophisticated, insurance companies must do the same. The large volume of insurance applications and claims means that artificial intelligence (AI), including machine learning (ML), is increasingly used for auto insurance fraud detection. ML technologies allow insurers to analyze large amounts of data in real-time, learning from fraud patterns so they can effectively detect both new and previously seen fraudulent activities. This allows insurance companies to accurately assess risk to make informed underwriting decisions and process claims effectively.

Vehicle technology has advanced rapidly in recent years. Telematics refers to technology that monitors, collects, and transmits data from objects or places. For auto insurers, telematics usually involves data exchanges about vehicles and drivers. Most insurers have not yet figured out how to fully utilize the huge amounts of available telematics data; insurers who invest in technological capabilities such as ML algorithms can be a step ahead of the market in harnessing telematics data.

With AI, more data means better insights. In Canada, executives interviewed for the 2023 CGI Voice of Our Clients program stated that data to improve underwriting and customer evaluation was a top business priority. Generative AI also has the potential to improve auto insurance fraud detection by making it easier for companies to leverage diverse data, such as unstructured data in image form or raw sensor data, as well as demographic and psychographic data.

Why Insurers Needs Partnerships

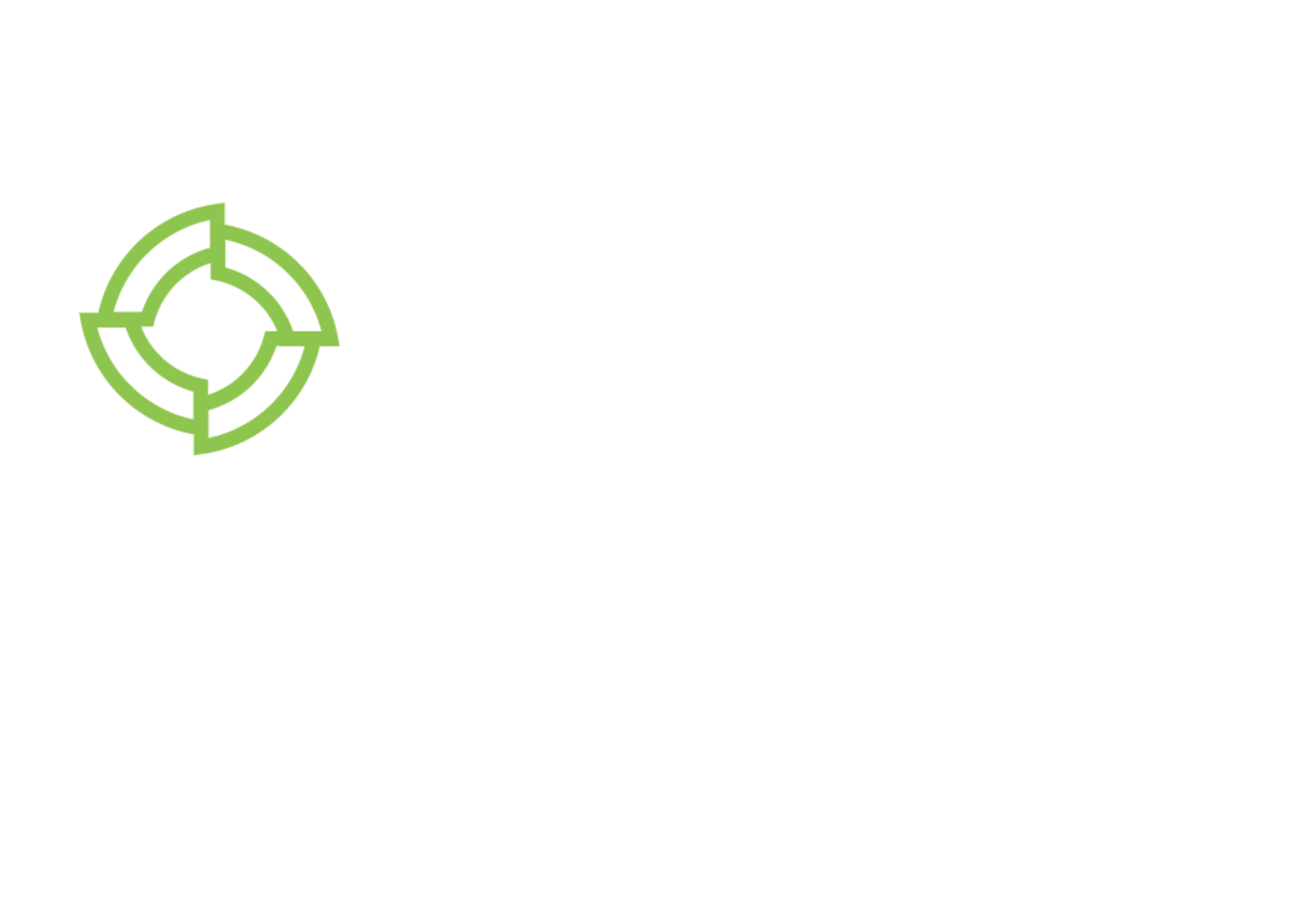

In order to maximize data access and improve fraud detection, insurers must collaborate with each other and with others across the auto insurance ecosystem, including Insurtech companies, original equipment manufacturers (OEMs), repair shops, and the public sector. Globally, insurers are increasingly willing to share fraud data.

An example of collaboration to leverage telematics data in Germany is the partnership between Mercedes Benz (OEM), HDI (insurer), Swiss Re (reinsurer) and Movingdots (Swiss Re’s tech arm in the auto space). In this partnership, Mercedes Benz makes connected vehicle data available to Swiss Re and Movingdots, with the aim of fostering driving safety and lowering insurance costs.

Yet too often insurers fail to achieve the full benefits of data collaboration due to concerns around:

- Protecting IP and competitive advantages

- Data protection legislation and contractual limitations

- Technology and data costs, including integration issues

Privacy-Preserving Collaboration

When insurers look beyond their business-as-usual practices, they can discover innovative solutions to solve these challenges. Privacy-preserving data collaboration enables insurers to enjoy the benefits of sharing data while complying with regulations and maintaining customer trust. For example, privacy-enhancing technologies (PETs) enable secure, privacy-preserving computations, in which the collaborating parties do not move or share data with each other. With PETs, auto insurers can collaborate among themselves and across their ecosystem to analyze data and fight fraud successfully.

To learn about Inpher’s privacy-preserving solutions, visit our website.